Consumer Confidence Wanes for Second Consecutive Month, Fears of Looming Recession Continue to Grow

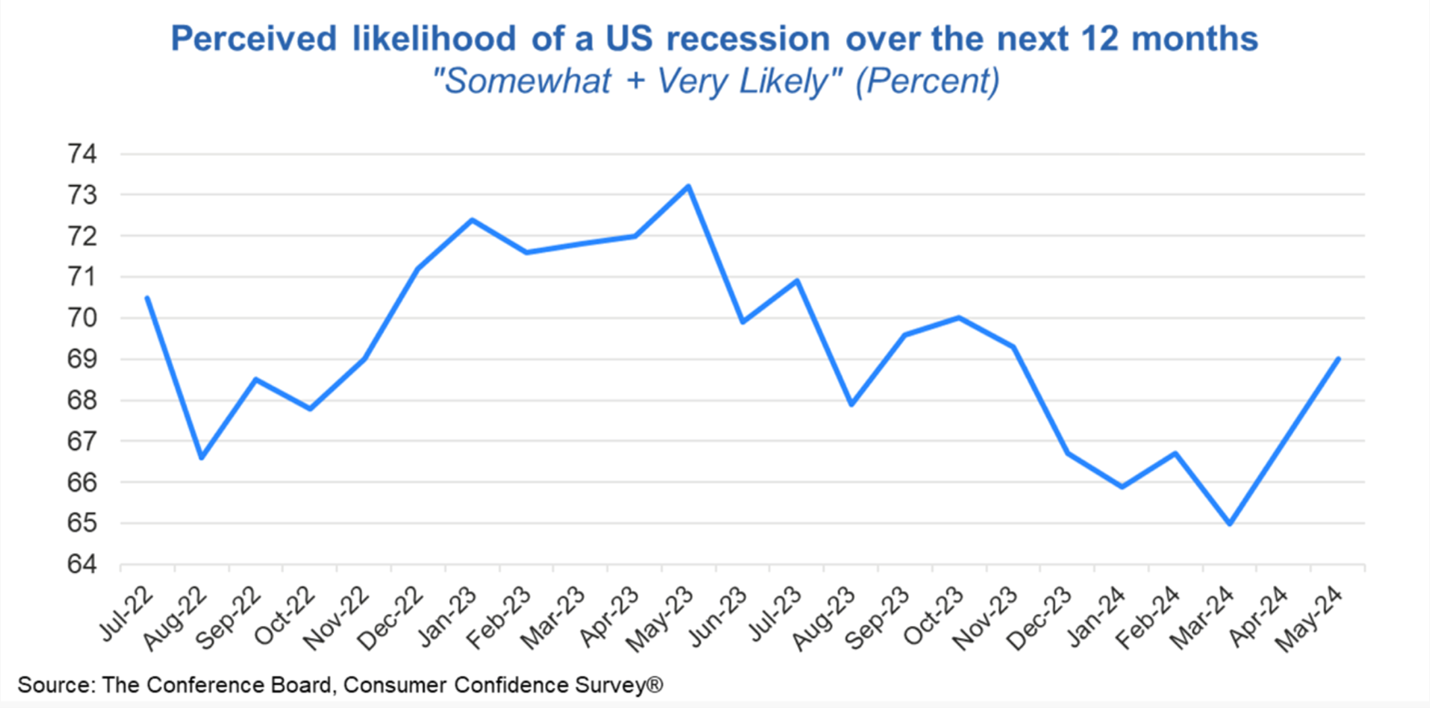

WASHINGTON, D.C. – Today, the Conference Board released its report entitled, “Confidence Ticks Up after Three Straight Declines but Consumers Remain Anxious about the Future,” evaluating Consumer Confidence for May 2024. The report described Consumers’ perceived likelihood of a recession over the next 12 months rose for the second consecutive month in May.

The Conference Board Consumer Confidence Index® measures the optimism or pessimism of households about their financial situation and their ability to secure or retain employment.

The report showed that while the overall index rose, for the fourth straight month, the Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions - was below 80, the level that suggests a recession is ahead.

Chairman Arrington on Consumer Confidence:

House Budget Committee Chairman Jodey Arrington (R-TX) released the following statement on Americans’ growing fears of a recession:

“Fears of recession rose for the second straight month. This is on the heels of a trending spike in inflation and paltry first quarter economic growth.

Whether the experts have determined we are in a recession or not, the American people feel the painful effects of their wages and savings receding.

We must rein-in Washington’s wasteful spending, return to proven pro-growth policies, and restore fiscal sanity in Washington before it’s too late.”

The Why:

Under the Biden Administration, unbridled spending and failed economic policies have further exacerbated the U.S. federal government’s looming debt and deficit crisis.

Since President Biden took office, inflation has risen by a staggering 19.3 percent, while families have had to spend nearly $17,000 more per year to maintain the same standard of living they could afford prior to President Biden’s leadership.

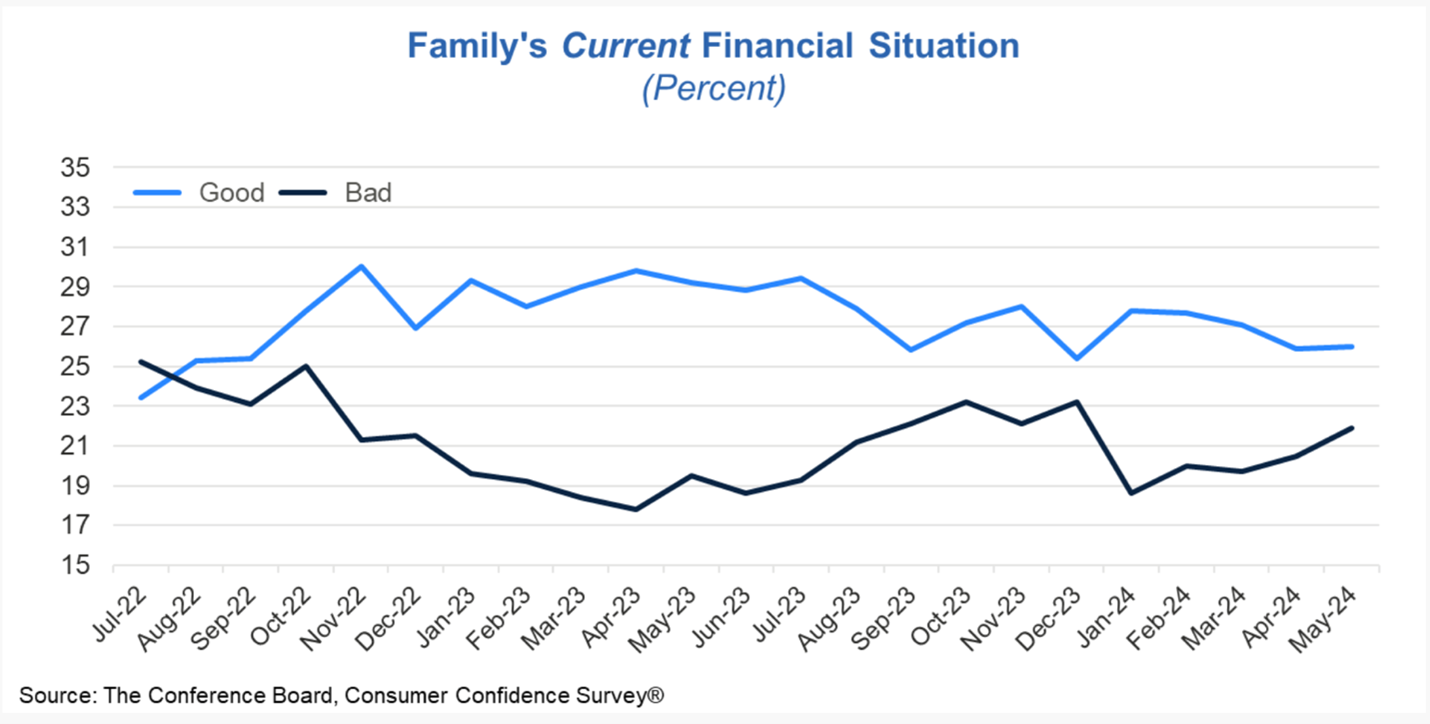

Comparably, the Conference Board’s May report depicts how Consumers’ assessment of their ‘Family’s Current Financial Situation’ has trended less positive for the month of May:

When coupled with stubbornly high prices and unpredictable economic indicators, the Consumers’ assessment of ‘Perceived Likelihood of a US Recession over the Next 12 Months’ rose for the second consecutive month in May:

The Bottom Line:

As Chairman Arrington has previously said on reigning in our nation’s debt:

“If we can grow one percent over the two percent that CBO projects over the 10 year budget window, just one percent that will bring down the deficit by $3 trillion.

But we have to link that with mandatory spending reforms and reining in the spending, and we have to be able to grow the economy faster than we're spending faster than we're borrowing.

If we do that. Just like our forefathers after World War Two did it. We can bring the debt to GDP down and we can have our best and brightest economic days ahead of us.”

More from the House Budget Committee:

- Read Chairman Arrington’s statement on the April inflation rate coming in at 3.4 percent HERE.

- Read Chairman Arrington’s statement on GDP rising by 1.6 percent for Q1 of 2024 HERE.